- October 7, 2020

- Posted by: saenicsa

- Category: Accounting, Business plans, Finance & accounting, Publication

Financial ratios help us to express a more meaningful relationship between two components of our financial statements and financial analysis helps us to have a more insightful understanding of a business.

You may also like: What is you Receivables Turnover Ratio? Why should you care?

This is why the use of financial ratios for financial analysis goes hand in hand.

For today’s article we will discuss just how exactly this synergetic relationship plays out.

What financial ratios are important in financial analysis?

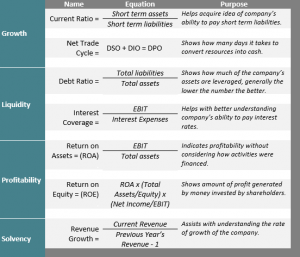

The main goal of financial analysis is to better understand our business within 4 main criteria, these being as mentioned in our previous article Growth, Liquidity, Profitability and Solvency.

It does not matter the main business activity because when analyzing a company these are the main criteria which are used. But, what tools of analysis are used in relation to these criteria?

Well, here are some of the most common ratios used to better understand each set of criteria:

| Growth | Liquidity | Profitability | Solvency |

| Current Ratio

Net Trade Cycle |

Debt Ratio

Interest Coverage |

ROA

ROE |

Revenue Growth |

What do these ratios mean?

At first glance the names of some of these ratios may seem intimidating and in fact only make them to be more complex than what they are.

Aside from using complex names and acronyms in fact a ratio is a very simple and straightforward equation. Many times, it is simply a question of either multiplication or division. When working with ratios what is really important to is make sure that the inputs for the equations are correct and accurate.

So, without further a due, below we breakdown each ratio and show the purpose of each one:

We hope that this has helped you improve your understanding of both ratios and financial analysis. If you have questions regarding either, feel free to let us know we would be glad to assist you.