- June 26, 2020

- Posted by: saenicsa

- Category: Accounting, Business plans, Consulting, Publication

The answer to this question may seem self-explanatory, but that is not necessarily entirely true. What do I mean? I mean that even though a possible answer to this question could simply be left at “business expenses”, in accounting there is a little more that can be said regarding the types of expenses that are paid in a business and how these are shown on a income statement.

So let’s discuss some of these points and see how they can affect our business.

COGS, or Cost of Goods Sold

If your business makes or sells a product there is a process that raw materials are subjected to so as to create the finished product.

The costs that are related to sourcing the raw materials needed to make your product and the cost of the process to take the raw material from its initial state to its finished state are all grouped together and kept separate from the rest of the other expenses that your business pays. This grouping of costs that are categorized within the parameters mentioned here are known as COGS, or Cost of Goods Sold.

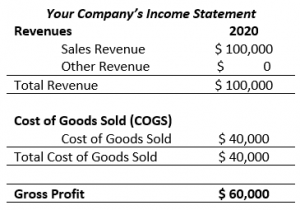

It is important to know this figure for the products that you sell, because on the financial statement you will see something like this:

The gross profit indicates a very important figure for your business, because the gross profit = (revenue-cogs), so here what you will see is what profit there is just between the cost to make your product. Therefore, it is important to pay special attention to this type of expense, because if it becomes too costly to produce your product you will go out of business.

What does EBITDA mean?

EBTIDA stands for Earnings Before Taxes, Interest, Depreciation and Amortization, EBITDA. Why is this important?

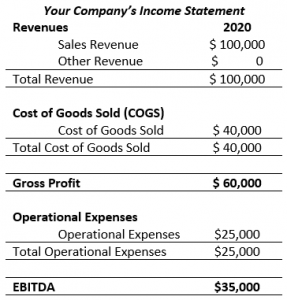

This is useful because once we have our Gross Profit the next part of the income statement is for Operational Expenses.

Operational expenses are the expenses that a business has that are for paying administrative, sales and other costs. So under operational expenses we have salaries, rent and so on.

Now when we subtract from Gross Profit our Operational Expenses, the next line item we get is: EBITDA.

Doing an exercise like this with our financial statements is useful when trying to compare the productivity and operational margin of a company, because EBITDA tells us in simplest terms how profitable a company is at making and selling their product without any consideration to: tax liabilities, financing costs, depreciable assets and so on. It isn’t that those points aren’t important, but you can look at a business’ EBITDA in Nicaragua or in China and they would be comparable.

We hope that this article on how business expenses are categorized has been helpful to you. If it has feel free to let us know.