How to apply and get residency in Nicaragua

According to the current legislation on immigration there are two kinds of residencies: Permanent: Which is granted for five years. Retirees, Rentiers and Foreign Investor receive this kind of residency. Those who receive it are not required to make a deposit equivalent to a one way ticket to return to their countries. Provisional: It is

Starting a business in Nicaragua

Nicaragua is located in the heart of Central America and has stood out in recent years for consistent economic growth, strategic location and for being one of the safest countries in the region. Today there exist many opportunities for investors that establish a business in Nicaragua. With a low barrier of entry, even compared with

Getting the most out of borrowed capital!

Sometimes financing is one of the biggest problems with an investment, but why is that? Well, an investment carries certain risks, these risks very from one project to another and whether using your personal money or a lender’s money those risks will be the same. The difference is that when using financing you can obtain

Inventory Optimization Techniques for Your Business

Proper inventory management is important for any successful business. There are many reasons for this, for example, it is important to manage inventory well so as to not have neither too much nor too little product available. Also, it is important to manage inventory well because you need to know what to buy, where to

Overtrading vs. Overcapitalization – What is this about?

Last week we touched on the topic of working capital. We defined working capital as a financial metric that is calculated by obtaining the difference between the total of current assets subtracted the total of current liabilities. Read more: What is Working Capital and How can I Manage it? Also, the importance that this metric

What is Working Capital and How can I Manage it?

When times are good, the income statement is the go-to report for management, but when times are lean, the Balance Sheet is what will keep your company from going bankrupt. An important metric that you can utilize to have a better understanding of your liquidity is the working capital metric, below we talk about what

The importance of Accounting Ratios in Financial Analysis

Financial ratios help us to express a more meaningful relationship between two components of our financial statements and financial analysis helps us to have a more insightful understanding of a business. You may also like: What is you Receivables Turnover Ratio? Why should you care? This is why the use of financial ratios for financial

Why is financial analysis important?

In a previous article we touched on the importance of accounting and the role that it plays in understanding the innerworkings of a company and keeping important financial information organized and understandable. Read more: Why is accounting so important? When we in turn talk about financial analysis, in reality we are discussing what is in

6 Ways Your Business Can Raise Capital Through Equity!

Getting the financing you need is very important to any businesses’ success and there are various different ways that this can be accomplished. What exactly is financing? Financing is a process in which funds are obtained so that a business has sufficient capital to cover costs and/or expenses. Many common ways of obtaining financing is

Exoneration of 15% IVA for Tourism Industry during the 14th & 15th of September

The 14th and 15th of September are national holidays in Nicaragua and this year they immediately follow the upcoming weekend. In an effort to increase sales and give a boost to the tourism industry, the President of Nicaragua has authorized an exoneration to the 15% IVA tax wherein those taxpayers who fulfill the following criteria

MITRAB – September 2020 Holidays

The Ministry of Labor, or MITRAB for its acronym in Spanish, just this week notified the general public as to its recent resolution in relation to the national holidays that are observed during the month of September of each year. This is due to the fact that as per article 66 of the Labor Code

Working during a Holiday

Holidays are occasions that many take advantage of to do things they normally wouldn’t do or enjoy time with family and friends since the opportunity of having a day off isn’t every day. For many holidays may mean well deserved time off, but for others holidays mean important an important opportunity to do more business.

It’s all about the Equity

There are 2 ways to finance a company, either through external creditors or from within – we are referring to the shareholders. It is important for a company to manage well what their obligations are to both creditors as also shareholders. This is especially true when starting out since it is important to manage this

Liabilities & Equity – What are these for?

Continuing with our review of the Balance Sheet, today we switch sides, from assets to liabilities & equity. Click here: What is the Balance Sheet? Just as it is important to be aware of what assets, both current and long-term assets our company has, it is also necessary to be aware of the obligations that

What does the ratification of the minimum wage mean?

Recently the Ministry of Labor and other adjacent organizations and labor groups met to ratify the minimum wage. In Nicaragua, the Minimum Wage Law states that the minimum wage should be adjusted each year twice, once during the month of March and again in September. It also mentions the manner in which this should be

Infinite and Finite Fixed Assets – An Introduction

In the article “What you need to know about Fixed Assets”, it was mentioned that Fixed Assets are an important part of any business, because we are referring to either property or equipment that generates income and has a useful life for longer than 1 year. We also mentioned that the types of fixed assets

What you need to know about Fixed Assets

During the past couple of weeks, we have been discussing some of the items that make up our Balance Sheet, such as Inventory and Accounts Receivable. In today’s article we will continue with the Balance Sheet by discussing the Fixed Assets section since this is another particularly important part of our Balance Sheet and when

Inventory Cost Flow Methods – What you need to know!

In a recent article we touched on the topic of Inventory and mentioned some of the innerworkings of this part of the Balance Sheet to help better comprehend one of the more complex parts of a businesses’ financial statements. Click here to read: Inventory – 3 Important things that you need to know! We will

Inventory – 3 Important things that you need to know!

The way your business manages its inventory can either result in being a critical step towards success or a shortcut to utter disaster. Why? Well with inventory there are many things that need to go right and many different variables that need to be taken into consideration for your business to function. It isn’t by

What is you Receivables Turnover Ratio? Why should you care?

A financial ratio is a manner of expressing a relationship between 2 components of your financial statements in a more meaningful way that gives a better idea of the financial standing of a company. Today we will discuss a very simple but important ratio we all should be aware of, especially taxpayers that invoice annually

What is our Client On-boarding Process?

At SAENICSA, we understand that choosing an accounting firm can be unsettling. Therefore, to make the process easier, the following will briefly discuss our client on-boarding process. Assuming that you have already accepted our proposed fee arrangement all that you need to do is the following: Review the NDA (Non-Disclosure Agreement) and send us

Understanding your Cash Flow Statement

Last week, we touched on how practical it is to have a and make periodic use of a Cash Flow statement. For example, we mentioned that net profit is not equal to cash flow and that neither is your total balance in your bank account. Similar topic: What is a Cash Flow statement? What is

Important Reminder: 19th of July 2020 Holiday in Nicaragua

The Labor Code in article 66 specifies that the 19th of July is considered a national holiday in Nicaragua and this year that day falls on Sunday. What does this mean for people that will work on that day? Read below to find out… What is the 7th day in the Nicaraguan Labor Code?

What is a Cash Flow statement? What is it for?

The Balance Sheet is a historical view of your company’s financial standing up to a certain date and the Income Statement shows what revenue there was, what costs and expenses were paid and what your bottom line is. But, what about cash? How much cash does your company have available? If your answer is, “I

What is the Balance Sheet?

One of the most important, but greatly overlooked statements within your financial statements is your Balance Sheet. This is because the Income Statement or what is also known as the Profit and Loss (P&L) statement is usually the go to statement that many business owners focus a lot of their time on simply because it

Now you can Renegotiate your Loans

Due to the current global pandemic of the #COVID19 and other factors that have had a significant impact on the Nicaraguan economy, many people and many businesses could renegotiate the credit terms of their credit cards, vehicle credits, mortgages, SME credits and others would do very well. Therefore, if you have not yet seen the

What expenses do businesses pay?

The answer to this question may seem self-explanatory, but that is not necessarily entirely true. What do I mean? I mean that even though a possible answer to this question could simply be left at “business expenses”, in accounting there is a little more that can be said regarding the types of expenses that are

Why is Accounting so Important?

Do you own a business? Are you thinking of starting one? Being your own boss is not a simple task. Anyone that has ever tried to do so can attest to that. In fact, many times it seams that when starting your own business, you end up working more than what you did when you

Important Capital Gains Tax Considerations for Nicaragua

It has been almost 8 years since the Ley de Concertación Tributaria, or LCT for its acronym in Spanish was approved by the Nicaraguan legislative body. Since then there have been changes that have modified the various articles of the national tax law. The most substantial changes made to the law were put in approved

Staying Home? Make sure to take care of your physical receipts!

Given that many of us are working at home and in fact even our team at SAENICSA is at home, it’s important to remember that in Nicaragua, it is imperative that you take good care of your invoices, receipts and other supporting documentation. The digitalization of many business processes and practices has meant that many

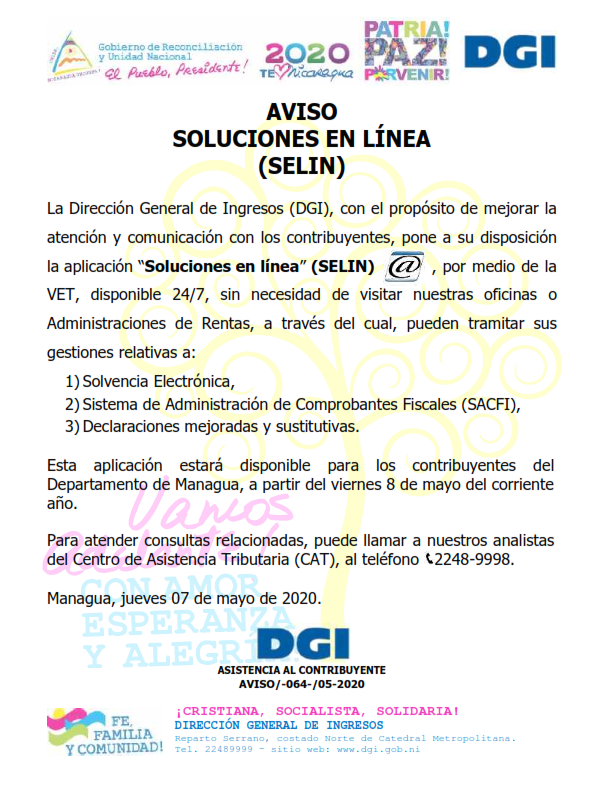

DGI introduces SELIN to Online Tax Portal

We just wanted to make sure that you were aware that the DGI has made public a new feature that they have integrated to their Online Tax Portal or Ventanilla Electrónica Tributaria in Spanish. The Online Tax Portal is the electronic method through which taxpayers present each month their tax declarations and other reports to

Staying Productive while Staying at Home

Staying productive… is easier said than done. In fact, from self-help books, hundreds of apps and even this article, we’re constantly reminded that we’re a lot better at being everything but productive. In business, maintaining productivity is vital and with COVID-19 were many businesses have now had to send employees to work from home, keeping

Business Continuity in the Midst of Crisis

Too few businesses are ready and prepared with a business continuity contingency plan to survive prolonged duress due to the effects of COVID-19. This has been more evident than ever before during this crisis. For the longevity of your business determined and swift action needs to be taken now for any possibility of continuity. Implement

Tips on Working at Home like a Pro

The usual morning routine for a lot of people has been abruptly changed. With the rapid onset of COVID-19 many businesses have had to quickly adapt to the circumstances. One of the many ways that businesses the world over are responding to this pandemic is by sending their employees home to work remotely. At SAENICSA

8 Tips on Confronting the Coronavirus Pandemic in Nicaragua

Given the sudden onset of COVID-19 and its devasting effects it has had on economies the world over, herein we have provided a few tips to keep in mind and consider on how to make the best of this crisis. We hope that this information is beneficial to you. Cash flow is the lifeblood of

Substantial Increase in DGI Compliance Audits

In recent months, the DGI has implemented new audit plans that have increased considerably in frequency. The increase in the frequency of these audits has been so much that many of these audits have become redundant. What is a Compliance Audit? There exist 2 main types of audits that the DGI utilizes: Compliance; Fiscal. The

Year-End Tax Declaration is Due on February 29, 2020!

According to article 69, numeral 1, of Law 822, Ley de Concertación Tributaria, which was amended with the entry into force of Law 978, Reforms and Additions to Law 822 Ley de Concertación Tributaria, taxpayers now have a term which corresponds to the amount of two months after the end of the fiscal period to

Declaration of Inventory to Tax Authority of Nicaragua for 2019

As the year 2019 draws to a close there are various year-end tasks that need to kept in mind and taken care of so as to not be penalized by the Nicaraguan Tax Authority. One of these obligations has to do with reporting inventory amounts as of December 31st . Who has to report? A considerable

Important Tax Deadline is Approaching

As of the 1st of March of 2019, important tax reforms were put into effect. The legislative bill that contained these changes was Ley No. 987 Ley de Reformas y Adiciones a la Ley N°. 822, Ley de Concertación Tributaria, or Law of Reforms and Additions to Law 822, Tax Concertation Law, in English. These

Maximizing Tax Deductions and Properly Supporting DGI Declarations – Nicaragua

No one wants to pay more tax than they need to. Therefore, it is important to comply dutifully with the requirements outlined by the Ley de Concertacion Tributaria and its bylaw, so as to be able to deduct all expenses and costs that are available to taxpayers. This article will discuss the importance of deducting

What is PEO and how is it changing the ways businesses do business?

Globalization and the internet have revolutionized commerce on a worldwide scale. All around the word businesses are getting into new markets, expanding product and service lines and acquiring clients in ways never imagined before. Business both on a local and international scale can be done in seconds instead of months or years. These changes in

Do you know why budgeting is important for your business?

To start, what is a budget? A budget is simply an estimate of revenues, expenses and capital reserves for a set period of time. It is an essential part of good financial practices and a helpful tool for business owners. At the end of this article we have a download link for a budget template

Taxpayer beware! Tax reform means significant changes in audit process!

The National Assembly approved towards the end of the month of February 2019 tax reforms that not only revised law 822 Law of Tax Concertation, but it also changed the law 562 which is the current tax code. Both of these laws and their respective bylaws are what regulate the national tax system in Nicaragua

WHAT YOU NEED TO KNOW ON, TAX REFORM!

Since the 25th of January 2019 a proposed reform to current the current tax law has been on the dock of the National Assembly, the legislative body of the Nicaraguan government. Given the current economic and social circumstances the proposed reforms have raised many questions as to the viability of implementing these changes. Putting aside

Year-end Tax Considerations for 2018

With the year 2018 drawing quickly to a close it is important to keep in mind the tax and accounting implications of having a business, as always. Although, unlike previous years the year-end close of 2018 will be especially important considering recent social and economic duress that has significantly changed various economic sectors within the

Withholding at the Source – What you need to know!

Taxes aren’t your friend, but you don’t want them to be your enemy either. In other words, even though taxes and the obligations that the local and national tax authorities may implement or require of businesses aren’t a “joy” to fulfill, nonetheless they are obligatory in nature – so it’s better to comply than to

How Nonprofits can assimilate Law 976 & 977 – Financial Analysis Unit & Anti-Money Laundering Regulations.

As mentioned in a previous post, Law 976 & 977, denominated Law of the Financial Analysis Unit (UAF for its acronym in Spanish) and Law against Money Laundering, Financing of Terrorism and Financing the Proliferation of Weapons of Mass Destruction (Ley de la Unidad de Analisis Financiero y Ley contra el Lavado de Activos, el

New Money Laundering Regulations – What to do?

In light of recent legislation, the Nicaraguan National Assembly (Asamblea Nacional, for its name in Spanish) authorized the passing of law 976 and 977, denominated Law of the Financial Analysis Unit and Law against Money Laundering, Financing of Terrorism and Financing the Proliferation of Weapons of Mass Destruction (Ley de la Unidad de Analisis Financiero

What is outsourcing? Is it for you?

If you own a business, most likely you started out doing the majority of work yourself. Of ourse, this sooner, rather than later, can quickly become a heavy burden. Definitely, the responsibility to make sure that your business day in and day out is a serious undertaking. What can be done? It is important to

Cloud Accounting – Seamlessly Integrated Systems

In every business proper system integration – is a must! It is imperative that the different systems that you use to run your business work well together and give you accurate and meaningful information. Even though there is effort and a modest cost involved, the end result definitively make the investment worthwhile. With cloud accounting

How Cloud Accounting can save you money!

Technology goes hand in hand with your business. If you want to be able to process orders quicker or provide an improved product technology is your best assistant. Also, if you are interested in lowering costs and increasing profits, your best bet is implementing technologies in the areas of your business that are underperforming. What

How to beat the Up-Hill battle of Starting a Business!

Usually a business starts as an idea. As the idea matures the “business” can take the form of a service or a product. Once that service or product is perfected, you begin offering it to your acquaintances and friends, who after having tried what you’re offering, will then recommend you to others. This is very

How to Retain and grow your Client Base

Clients are the lifeblood of every business. Thanks to your clients you have orders, cash flow and the opportunity to grow your business through referrals. Every business needs clients. That is why it is so important to take care of your clients and make sure that they know you don’t only appreciate them because they

How to get Client’s to pay…on time!

“A happy business owner is one with a positive cash flow”, is a saying that has a lot of truth to them. This is because there are many headaches that can be avoided by having sufficient cash to pay employees, bills and even oneself. In a perfect world every client would pay their fees when

Transitioning to the cloud accounting – Why?

With the emergence of technology that is now both in our mobile devices and our desktop computer and everything else in-between, new trends are now changing the ways that business is being done. In fact, now it is possible to run your entire business from your home, or wherever you decide that you want to

Your Inventory is Valuable – Manage it Properly!

Depending on the type of business that you own, whether it is a store, hotel, restaurant, etc…most likely inventory is an important part of your business. Although, as important as it should be unfortunately many business owners don’t dedicate enough time or effort to proper management. In our experience we have come across many who

Crisis in Nicaragua – What can I do with my employees?

Since the 18th of April of 2018, Nicaragua hasn’t been the same and the repercussions of this change can be seen and felt almost everywhere. For businesses this has especially been true. Since April of this year, various industries such as construction, tourism and transportation, among many other, have felt either a lull in customers

Investing in Nicaragua: Investment Opportunity in Forestry

Forestry is an important economic segment in various industrial countries. In Nicaragua this is one of the growing economic sectors that is not only being promoted by the government, but is also the beneficiary of various tax incentives. Some of the more common investments in Nicaragua that are related to the forestry industry are: Forest

Investing in Nicaragua: Fishing & Aquaculture

Nicaragua is considered, “the land of lakes and volcanoes”. This is because of the considerable number of lakes and lagoons that exist in the country. In fact, one of those lakes, Lake Nicaragua (Cocibolca) alone is the largest lake in Central America, being about 160 kilometers long and 75 kilometers wide. Also, there is a

Investing in Nicaragua: Agriculture Incentives

Have you considered investing in agriculture? The different types of agriculture related investments vary greatly and do not necessarily require for an investor to purchase and be tied to farmland, per se. In fact, in Nicaragua agriculture investments are varied and can take many different forms. Additionally, due to the fact that the country has

Get up to date information for your business!

Complete form below: