- July 21, 2020

- Posted by: saenicsa

- Category: Accounting, Business plans, Consulting, Publication

Last week, we touched on how practical it is to have a and make periodic use of a Cash Flow statement. For example, we mentioned that net profit is not equal to cash flow and that neither is your total balance in your bank account.

Similar topic: What is a Cash Flow statement? What is it for?

Also, we mentioned some of the benefits that creating and using a Cash Flow statement can give a business owner especially in regard to whether or not a company is generating sufficient liquidity (cash) to cover obligations.

Now continuing with that topic today we are going to discuss how we can get a better understanding of exactly what this statement is telling us.

What does a Cash Flow Statement look like?

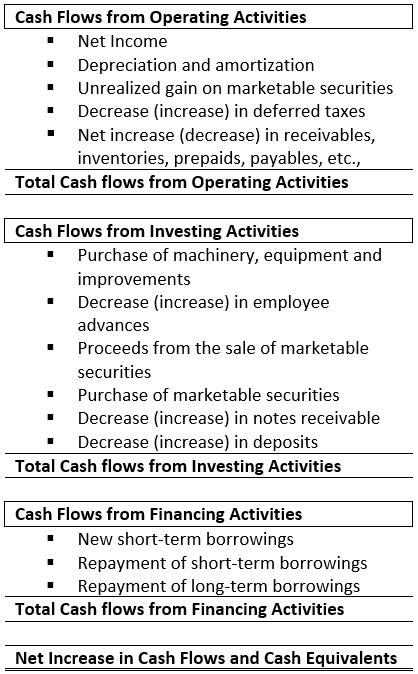

If you have never seen a Cash Flow statement before, it is somewhat similar to an Income Statement. To give you and idea of what it would more or less look like, see below:

What are the 3 types of Cash Flow?

In our last article we touched on the importance of this statement since it helps us to better understand the cash that flows in and out of the business. As you can see there are 3 types of Cash Flow categories that are shown on the statement, being as follows:

- Cash flows from Operating Activities;

- Cash flows from Investing Activities; and

- Cash flows from Financing Activities.

What do these Cash Flow types mean?

The Cash Flow type, Operating Activities, refers to the cash that originates from your main business activity. So, this means that all the money that was generated for your business selling the product or service for which it is known for.

Now Cash Flows from Investing Activities is different, since it only takes into consideration cash that was generated from when your company had money invested in financial instruments in capital markets or capital investments in other businesses.

And finally, the Cash Flows from Financing Activities refers to the cash that your company generated either through receiving additional equity through shareholders or when receiving capital through external third-party (banks and other financial institutions) sources.

How does this benefit me?

Now that you have a clearer idea of what a Cash Flow statement is, its functionality and purpose, it is important to make good use of this statement.

In reality, the Cash Flow statement is taking important information from both your income statement and balance sheet while providing you a clearer idea of one of the most important parts of your business, liquidity (cash).

Therefore, when you can clearly see not only the availability of cash within your business, but also the sources, this permits you to better manage your budget and financial obligations.

With this information you can make important strategic decisions, such as investing or divesting in a separate venture or expansion of your current business. Also, a Cash Flow statement can help you decide whether your business is over-leveraged (carrying too much debt) or it can tell you the exact opposite and in fact show that additional capital financing could open the opportunity for further growth.

So, make the best use of your Cash Flow statement!