- September 2, 2020

- Posted by: saenicsa

- Category: Accounting, Consulting, Publication

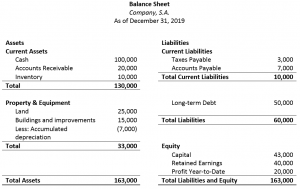

Continuing with our review of the Balance Sheet, today we switch sides, from assets to liabilities & equity.

Click here: What is the Balance Sheet?

Just as it is important to be aware of what assets, both current and long-term assets our company has, it is also necessary to be aware of the obligations that need to be taken care of, both to our debtors as to our shareholders.

With this in mind, lets talk about the liabilities and equity side of our Balance Sheet.

What are liabilities?

Liabilities are an important part to any company’s Balance Sheet.

To explain, when we are talking about liabilities, we are talking about what we owe to debtors. Now there all kinds of debtors that a company can have, such as the Treasury Department – if we owe tax – , providers of goods and services, and even financial and banking institutions.

The obligations therein are divided similar as to how are assets are divided. I am referring to that there are both current and long-term liabilities.

How do we differentiate between current and long-term liabilities? Current liabilities usually have a term life of 1 year or less, while the latter can refer to financial obligations that may take years to pay off, such as a mortgage.

What is equity?

Equity is something that no company can exist without. Why?

Well, when we look at equity, we are talking about financing that is coming from within the company itself. For example, the amount of money that shareholders have contributed to the company, profits the company has accumulated over the years and even current year-to-date profits.

In Nicaragua, all company’s need to have an initial paid-in capital, this is known as the “Capital Social”, therefore, as mentioned above there cannot exist a company without equity.

What is the difference between Liabilities and Equity?

When we look towards the right-hand side our Balance Sheet, you may notice that there are 2 different sections, one that says liabilities and another that says equity.

Even though both of these sections are on the same side other than that they really don’t have much more in common.

What do I mean? I mean that other than both being ways of financing our company’s activities, liabilities and equity are very different things.

So, to put into simplest terms the difference between liabilities and equity is that the former is financing that a company receives from third parties and the latter refers to financing that was sourced from within.